Choosing a structure for a business is a crucial step and will affect all day-to-day operations of the business, such as filing requirements, the ability and procedure for raising capital and personal liability.

In the Isle of Man, a company can be incorporated under two distinct regimes, namely, the Companies Act 1931 (a “1931 Act Company”), which is based on the UK Companies Act 1929, or the Companies Act 2006 (a “2006 Act Company”), which introduced a more flexible structure.

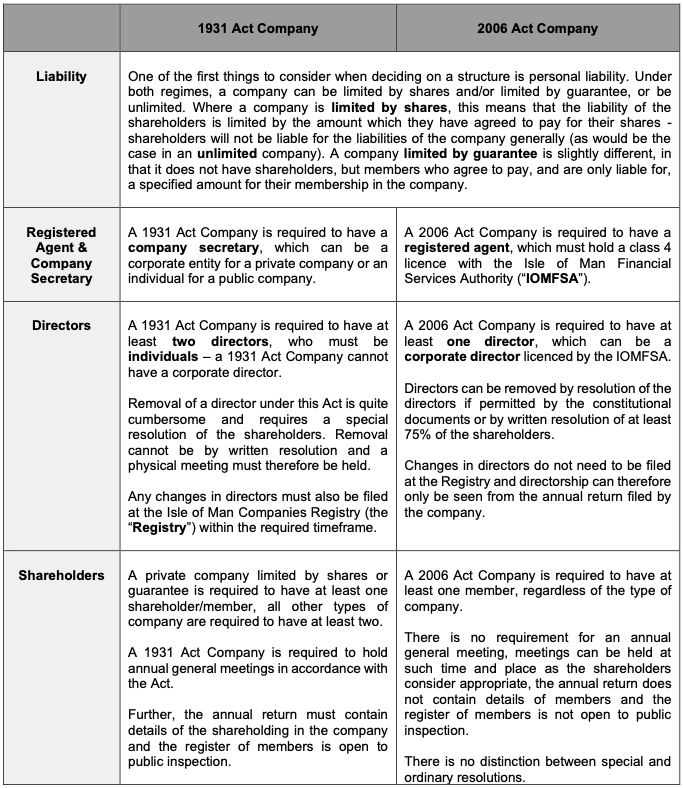

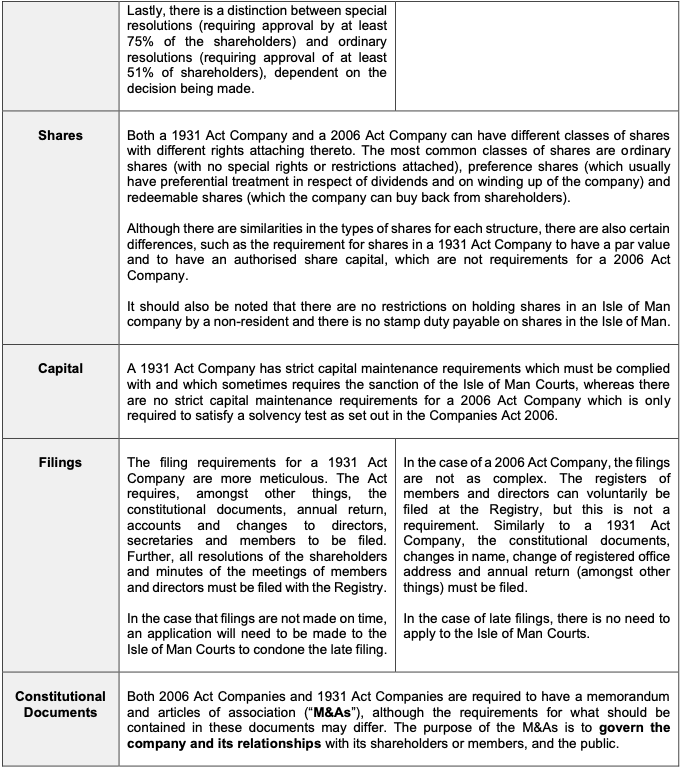

In this article below we outline both structures and important factors which should be taken into consideration before choosing one (which may be subject to any specific provisions to the contrary in the constitutional documents of the relevant company):

The above table covers only some of the key considerations to be taken into account when deciding on a structure for your business, there are numerous other factors which should also be considered.

Apart from a company incorporated under the above Acts, the following other business structures could also potentially be utilised to structure a business:

- A foreign company which is not incorporated in the Isle of Man but has a place of business in the Isle of Man and is registered on the Register of Foreign Companies. Filing requirements for a foreign company are similar to a 1931 Act Company.

- A protected cell company (“PCC”) which is limited by shares (and the shareholders have limited liability) and incorporated under either the Companies Act 1931 or the Companies Act 2006. A PCC has distinct cells which each have their own assets and liabilities, which cannot be used for the debts or liabilities of another cell. Each cell has its own shareholders.

- A limited liability company (“LLC”), which operates as a partnership but with separate legal personality, limited liability and has its own constitutional documents.

- A partnership, which can be a limited partnership registered as such at the Registry (with one limited liability partner and at least one general partner who manages the day to day affairs of the partnership with unlimited liability) or a general partnership (no limited liability members).

If you would like further information on this subject please contact Rachel Winterbach or Kim Emery.

Rachel Winterbach

Disclaimer

The information and/or opinions contained in this article is necessarily brief and general in nature and does not constitute legal or taxation advice. Appropriate legal or other professional advice should be sought for any specific matter. Any reliance on such information and/or opinions is therefore solely at the user’s own risk and DQ Advocates Limited (and its associates and subsidiaries) is not responsible for, and does not accept any responsibility or liability in connection with any action taken or reliance placed upon such content.